An apparent shift by iPhone 3G buyers to lower-priced 8GB models reportedly prompted Apple to trim by 4 million the number of handsets it will build for the rest of 2008. Cupertino will order 14 million to 15 million phones instead of 18 million analysts first projected.

Pacific Crest’s Apple analyst said Friday “supply-chain checks” found since mid-September Apple is not meaningfully resupplying AT&T stores that have sold down their inventory of 8GB iPhone 3Gs.

“The popularity of the 8GB model reinforces our concern that smartphone demand has shifted to a lower price point,” wrote Pacific Crest analyst Andy Hargreaves.

The analyst said if Apple decides to drop the iPhone 3G 16GB price to $199 from $279 and introduce a 32GB model for $299, the announcement could further pressure component suppliers.

With the possibility of fewer 8GB iPhones, Hargreaves lowered by $5 million quarterly revenue expectations for Skyworks Solutions and Triquint Semiconductor, which both make power amplifiers for the 8GB iPhone.

The projected cut in iPhone production for the remainder of 2008 could also hurt memory makers SanDisk and Micron Technology already battered by low NAND prices, Pacific Crest believes.

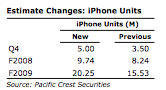

Like other analysts, Hargreaves cited “improved confidence” and upped his expectations for iPhone sales. He now believes Apple will have sold 11 million iPhones for the first half of 2008, an increase from 8 million previously predicted. The projection means Apple CEO Steve Jobs will sell 9.74 million for the full fiscal 2008.

14 responses to “Apple To Build Fewer iPhone 3Gs For Rest Of 2008”

And, how do we know Hargreaves of Pacific Crest Secs, has his finger on the pulse of the supply chain? I have yet to see one of these supply chain source rumors pan out.

Wow, I didn’t ‘supply-chain checks’ can predict how many the iPhones Apple will be selling.

This anal yst is only second guessing as usual. I wish this guy will get sue for misleading the market when his second guessing didn’t come true.

Triquint never provided quidence based on anywhere near selling chips for 18 miliion I phones. I also never saw that Pacific Crest ever raised their revenue estimates for TQNT in the first place. Tqnt will come in on the high side of their guidence or even beat the numbers. True TQNT has a big win in Iphone but it also has a diversified customer base. Looking for jigher margins and higher revenue.

I can’t believe you actually fall for this FUD being spread by CNET’s anti-Apple dynamic geek trio. CNET’s article real purpose was as pre-emptive strike to show the crumbling business world that it’s not only RIM who’s suffering at the stake of the econony; but look Apple’s cutting back supplies of smartphones too. Notice how these articles never really pinpoint a real source- that’s because their all bogus and full of crap.

Adam: Think of supply-side checks as reverse-engineering a company’s plans. If AT&T tells you you are selling tons of 8GB iPhones, but Apple isn’t shipping more, it usually means something is afoot — like the 8GB doesn’t have a future. We’ve seen the same supply-side checks with chips to determine Apple’s plans. A while back, word went out from Asia that Apple had placed an order for a boatload of memory chips; soon after the iPod nano appeared which was highly-dependent on (guess what?) memory chips.

Pacific Crest is an Investment Bank if you want to believe the FUD those idiots put out you can, I don’t. Lehman Brothers should be a telling story on why not to believe anything these investment bankers say.

Hi Ed, let’s see.

BTW he should have cited at least one supplier in his supply chain checks to make his analysis more credible otherwise his report does not hold any water.