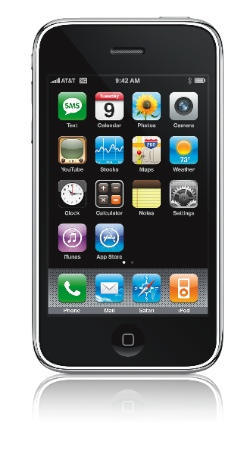

Apple’s iPhone was among one of the few bright spots in a gloomy third quarter for cell phone manufacturers.

Apple now has 2 percent of the global cell phone market during a time when cell phone makers scrambled to adapt to slowing consumer sales. In September, the Cupertino, Calif. company reported selling 6.9 million iPhones during the third quarter, a 516 percent jump over the previous year.

“Apple has become firmly established as a top ten vendor,” Strategy Analytics announced.

Analysts Thursday said global cell phone shipments either shrank or rose a tepid 5 percent to 8.5 percent.

The third quarter typically sees cell phone shipments rise by double digits as carriers prepare for the holiday buying season. However, faced with an economic downturn, cell phone shipments during the three months ended Sept. 30 hovered in the single digits.

The quarter was the worst since 2002, Strategy Analytics said. The firm said “lackluster” holiday sales in developed countries coupled by fewer sales in developing countries will likely result in 345 million handsets sold during the fourth quarter.

IDC analysts reported global cell phone shipments of 299 million handsets, a 0.4 percent drop compared to the second quarter. The analyst house said handset shipments rose only 3.2 percent for the year, compared to previous years when growth reached as high as 20 percent.

Apple’s market share rose 2.2 percent during the third quarter, according to ABI Research Thursday. Rival RIM gained 2 percent share. ABI estimated global cell phone shipments rose 8.2 percent from the previous year.

“The big winner in Q3 was certainly Apple. They beat RIM in terms of shipments, which is a huge feat and certainly proved that they can get success from one device,” IDC analyst Ryan Reith told Cult of Mac.

Handset giant Nokia saw its market share fall to 37.7 percent from 39 percent a year ago, while Motorola’s share dropped to 8.1 percent and LG slipped to 7.4 percent.

“Given the traumatic news ricocheting around the financial markets, one would almost expect mobile handset markets to have nosedived,” analyst Jake Saunders said in a statement.

Smartphones were a “major weakness” for Nokia, according to Strategy Analytics. Smartphones are “capturing the imagination of the public,” ABI research director Kevin Burden said.

As for Motorola, the number two vendor saw shipments drop 32 percent as sales declined faster than the second quarter.

Both cell phone buyers and manufacturers are responding to the changing economic landscape. Despite improving handset performance, consumers are choosing not to upgrade. Handset companies, in turn, are increasing mid-priced and low-priced cell phones, according to ABI.

Analysts have scaled back their estimates for the fourth quarter. ABI reduced its projection to 7.5 percent from 10.4 percent. The firm expects yearly growth to reach between 10.5 percent and 11 percent with 1.27 billion phones sold globally in 2008.